Your financial statements are a lot more than just another report.

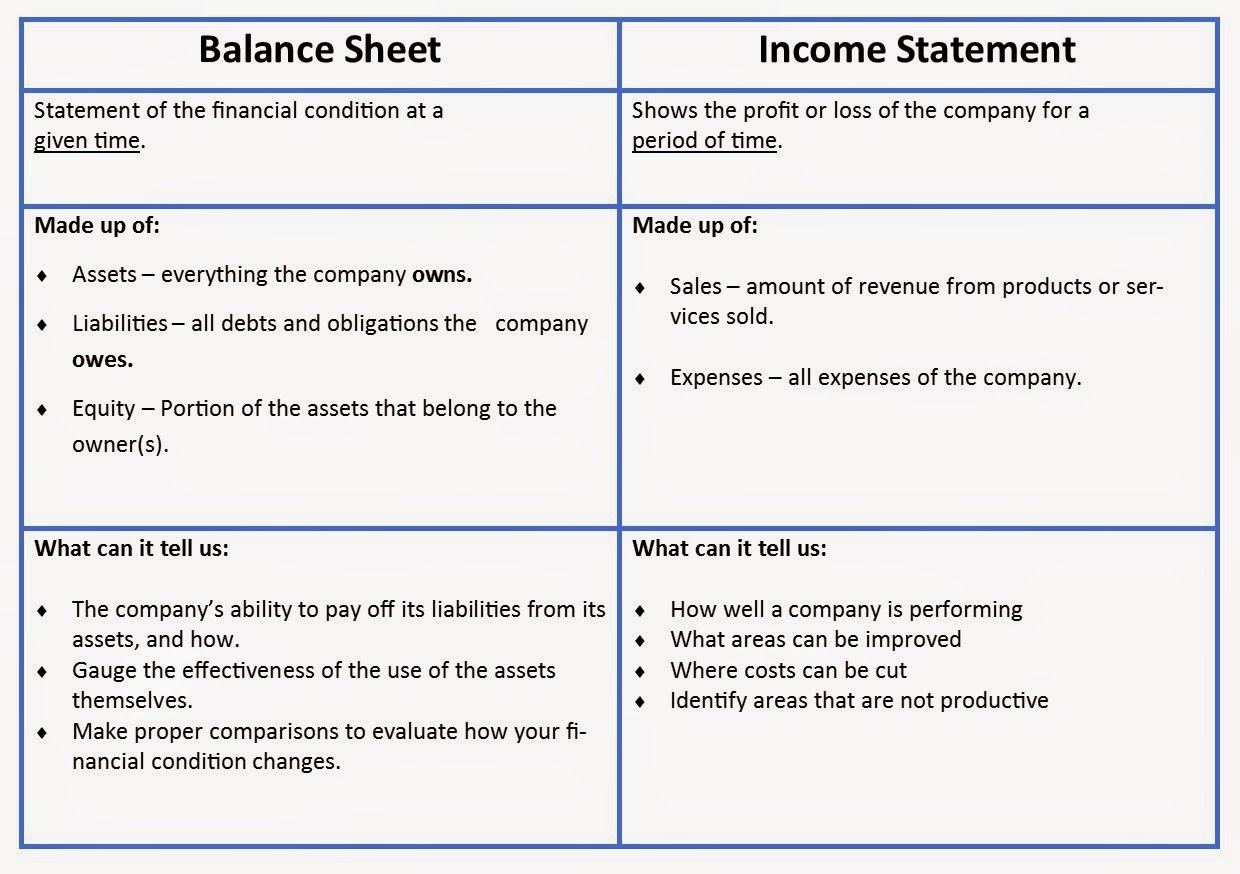

Let's look at what your Balance Sheet, and Income Statements can tell you!

Both the Balance Sheet and Income Statements are vital reports for understanding your business. However, they each play a different role in that process.

Now, we'll get into more detail about what they can tell us

Take a look at this Balance Sheet

- The financial reports below are fictitious and do not represent any real company.

Okay, so now what do we know?

Current Ratio = 2.5

This means that this company has enough Current Assets to pay off its Current Liabilities, in full, at least twice. This company has a good current ratio.

Quick Ratio = 0.63

With this calculation we know that this company could NOT pay off its Current Liabilities using only the current cash and accounts receivables. This company will need to turn other Current Assets into cash before it can pay off all Current Liabilities at the time this report was run.

Asset to Equity Ratio = 58%

This number tells us that 58% of this companies equity is from the owner, and 42% of the equity is from liabilities (debts). The health value of this number varies by industry, and is most helpful when used to compare to other points in time or to other businesses in the same industry.

Productivity Ratio = 18%

This is the rate of return on the total assets, or the return on the overall investment made in the business. This number is most useful when used to compare with previous statements.

The same formula can also be used to find the effectiveness of each individual asset.

Operations Ratio = 10%

The rule of the thumb is to have a percentage above 7%.

This ratio defines a companies profit margin before interest and taxes are taken out.

Expense Ratio (salaries expense) = 41%

This formula can be used on any expense item. It tells you what percent of sales any expense item is. I chose to demonstrate with the salaries expense and learned that 41% of sales revenues was used to pay salaries.

Inventory Turnover = 2 times per year

This number defines the number of times inventory has been purchased and sold for the time period of this Income Statement. Generally inventory should turn over around 3 times per year at minimum.

Average Age of Accounts Receivable = 266 Days

Tells a business how many days, on average, their accounts receivable remains uncollected. Typically the accounts receivable should fall within 30 to 90 days, depending on your companies payment terms.

As you can see this business should evaluate which customers are typically paying late.